Has anyone noticed that the reporting on the War on Terror, especially in the Middle East, has gone from rants and editorial hate speech against the war to a monotone

that reminds me of reading English language Pravda in the 1970s and listening to PBS radio news today? Why is this occurring?

Now that Tony Blair has announced he will stand down as PM of the United Kingdom and the Democratic Party has taken up leadership positions in the United States Congress after railing in concert with the drive-by, mainstream media against the Iraq war, an inconvenient truth has come forth: THERE IS NO PLAN EXCEPT TO CUT AND RUN from the newly elected leadership.AND THAT WON'T WORK.

Illustrating this view is Sir Barak Obama (D. Sen. Il), he of deep voice and deep loyalty to the corrupt Democratic Party in Chicago, when he states that we should "withdraw in six months". Why not immediately? Why not in seven months? Have his far left backers such as George Soros and the multi-million dollar shakedown machine of the Jesse Jackson family giving him marching orders? HRM Obama wants to be the Vice President in 2008 on a Hillary Clinton ticket. Is he and a few others of prominence taking a far left position as per Senator Clinton's request so she can position herself as a moderate for the 2008 presidential race?

Meanwhile, anti-Semitic hate speech is increasingly creeping into the mainstream media and being accepted by those who choose to forget the decade of the 1930s.

The only democracy in the Middle East is being led back to a pogrom which Jews have been subjected to every fifty years or so somewhere since the Romans.

The State of the World is not good, and getting worse because there are too few willing to stand up and be counted against Islamic fascism and Jew baiting on the fringes of all other players on the world stage.

The War on Terror and military strategy now being pursued and contracted by the defense agencies of the United States leads me to the following conclusions:

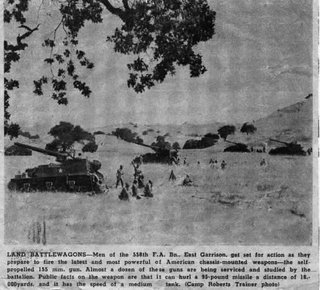

> As mentioned months ago, we are getting out of Iraq for the most part by summer. Senator Osama Obama (a slip by Senator Ted Kennedy last winter) will get his wish, but because it is already in the works. Most troops will be withdrawn to adjacent countries by July, 2007 and, if /when another terrorist debacle hits United States soil, deployed on the home front.Technology will replace boots on the ground in many places. This presents excellent opportunities for Aerodefense stocks previously mentioned.

> Israel will become increasingly isolated and will have to pursue additional WMD's on its own. Iran and Syria will become even more hostile throughout the Middle East area and beyond. It is my belief that no present moderate Arab states are in immediate danger, due in large part to a firm line drawn in the sand by countries interested in hurting the long term interests of the United States, yet still needing viable, reliable countries to extract resources from for economic benefit.No war for oil.

>Look for terrorist cells to operate in a quasi Arab-Latino connection with the overt support of Cuba, Venezuela and Mexican officials receiving bribes from terror states.Our southern border will become an even greater issue. A national identity card may well receive bi-partisan suport.

> The War on Terror will gradually shift focus from Iraq and Afghanistan to Europe , Australia and North America. Europe may be past the point of no return from a socio-political standpoint unless fresh, aggressive leadership emerges to combat the inability at present to counter radical Islam from military and law enforcement positions . Europe is too weak now to do much of anything. Russia is gloating and using enhanced intelligence operations and power politics to extract technological and economic skills at little or no cost to prop up their poorly crafted communist light system and become a strong player on the world stage by 2010.

>China will do what is necessary for North Korea to be nothing more than a nuisance to the northern Pacific region and the United States. China wishes to keep North Korea in the game to sap resources from Japan and South Korea for economic and strategic advantage. China itself has developed a military machine that is being designed to win an aggressive, short war when China determines the west too weak to mount a lethal defense. My estimates from reliable sources indicate this should happen, present trends staying the same, around 2020. We have already had many incursions and cyber attacks from China, fishing for weakness in our military and corporate infrastructure. Lasers were directed at our most sophisticated intelligence satellites this past summer, results being classified.

From an investment standpoint, we have little to be concerned about short term. The markets and economy are wonderful. However, the intermediate and longer term is problematic, perhaps catastrophic. Strong leadership, a will to win and the desire and practice to promote capitalism and a form of democracy on all continents will be the deciding factor in the end. One hopes that individualsof influence will come to this conclusion for the sake of our well being and future generations.